Original artile: https://medium.com/bankofchain/bank-of-chain-%E5%8A%A0%E5%AF%86%E5%B0%8F%E7%99%BD%E4%B9%9F%E8%83%BD%E7%A8%B3%E8%B5%9A%E4%B8%8D%E8%B5%94-8a529812ad58

Google Translate:

An overview of the first DeFi Bank, how it works, and its present and future.

After seeing what decentralised finance (DeFi) is in the previous article, let’s go deeper into what is Bank of Chain (BOC) and how it is related to the DeFi ecosystem.

What is BOC?

BOC is the first decentralized bank (DeB), a multi-chain yield optimizer which provides the best long-term near risk-free return and helps ordinary investors to obtain a wealth management tool on the blockchain, seeking to articulate the best of traditional banks with the best of DeFi protocols.

BOC brings together the best of both worlds, delivering higher returns than traditional banks, but also making them more stable than most DeFi protocols. DeFi unlocks high returns, BOC makes them sustainable; in other words, in decentralized finance, it is possible to obtain high returns but they tend to have high volatility due to risk, BOC manages to make those returns sustainable.

In what sense is BOC bank-like?

It features a similar user interface, offering personal bank statements and one-click deposit/withdrawal facilities. BOC also provides equivalent services to banks such as wealth management and lending, this last one is under development and pending implementation.

BOC issues high-yield certificates of deposit that function like banknotes: $ETHi and $USDi are interest-bearing tokens whose parity is pegged to $ETH and USD correspondingly, they are stable, fully liquid and fully backed since for every ETHi minted, there is one $ETH deposited BOC’s vaults and for every USDi minted, there is one USD deposited as well.

How does it work?

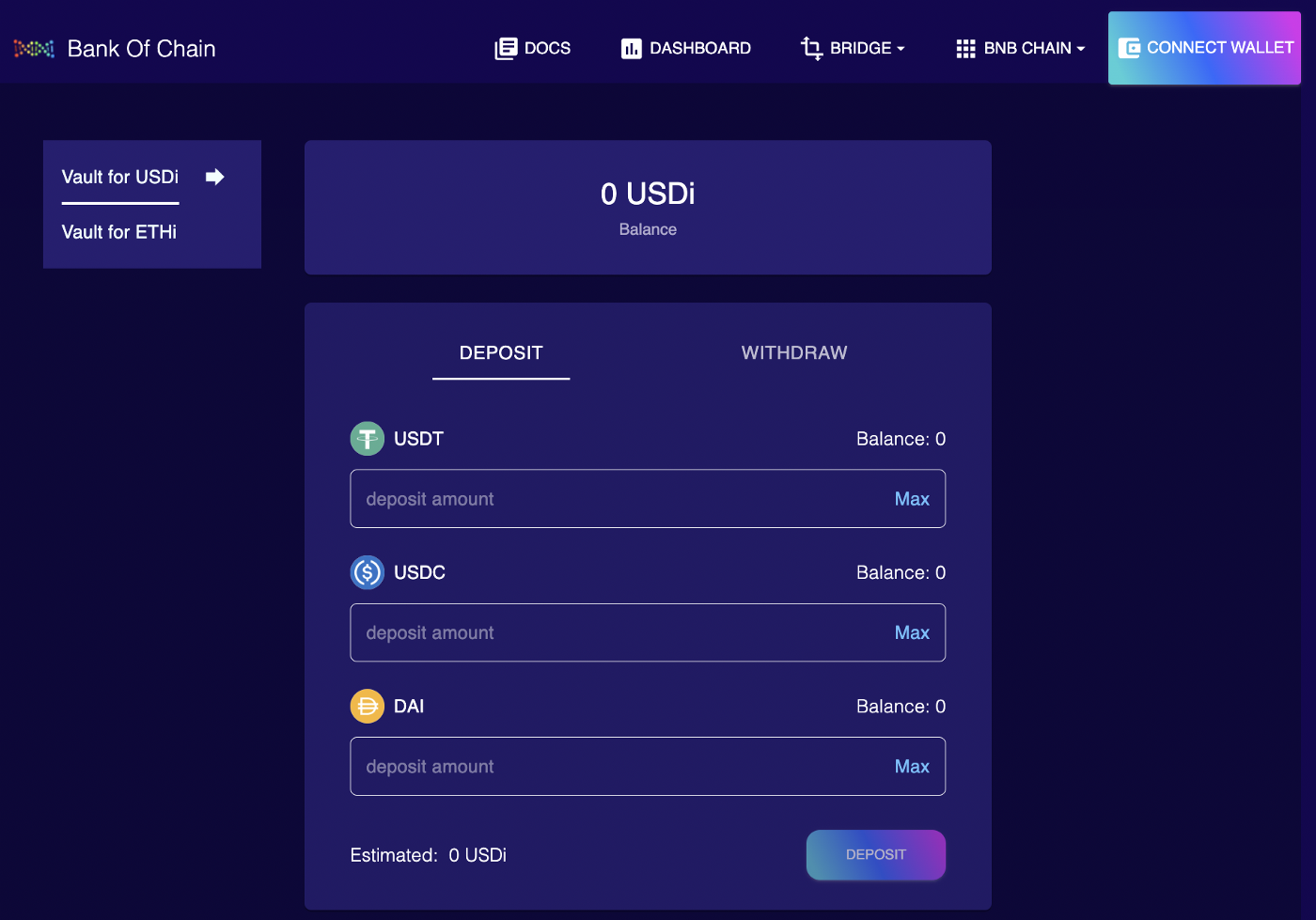

In order to start earning returns, you simply connect your wallet (Metamask or Wallet Connect) and deposit stablecoins into the BOC protocol, it will start generating interest immediately.

BOC only accepts asset-backed stablecoins, as they are more secure and stable, and currently include $DAI, $USDT and $USDC, although there are plans to add many more stablecoins that meet the same requirements.

By depositing any of these three stablecoins, you receive $USDi as a certificate of deposit, pegged to USD. You can also deposit $ETH and receive $ETHi the same way as $USDi, and since $ETHi is pegged to ETH, it is stable as well.

In turn, these certificates of deposit will increase the amount in themselves and generate the return BOC provides as APY to depositing users. Moreover, the return is compound, i.e. it is automatically reinvested by increasing the investment base on which further returns will be generated.

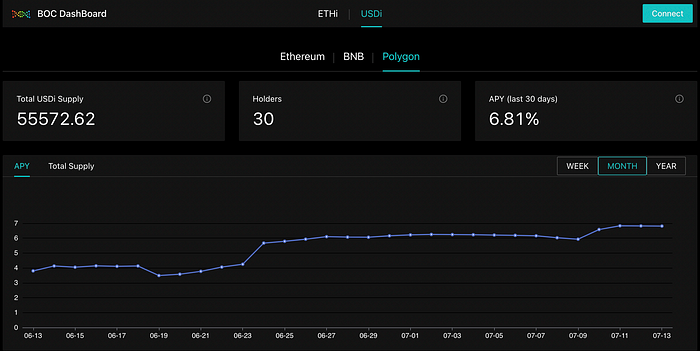

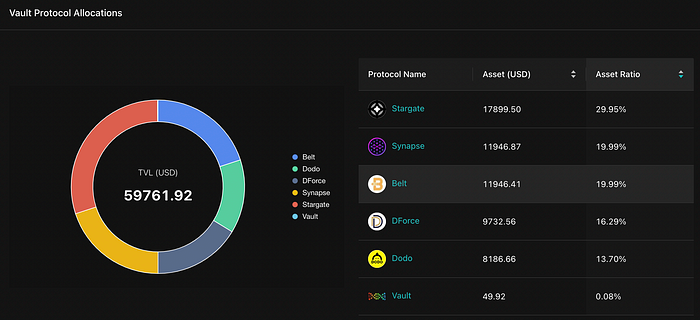

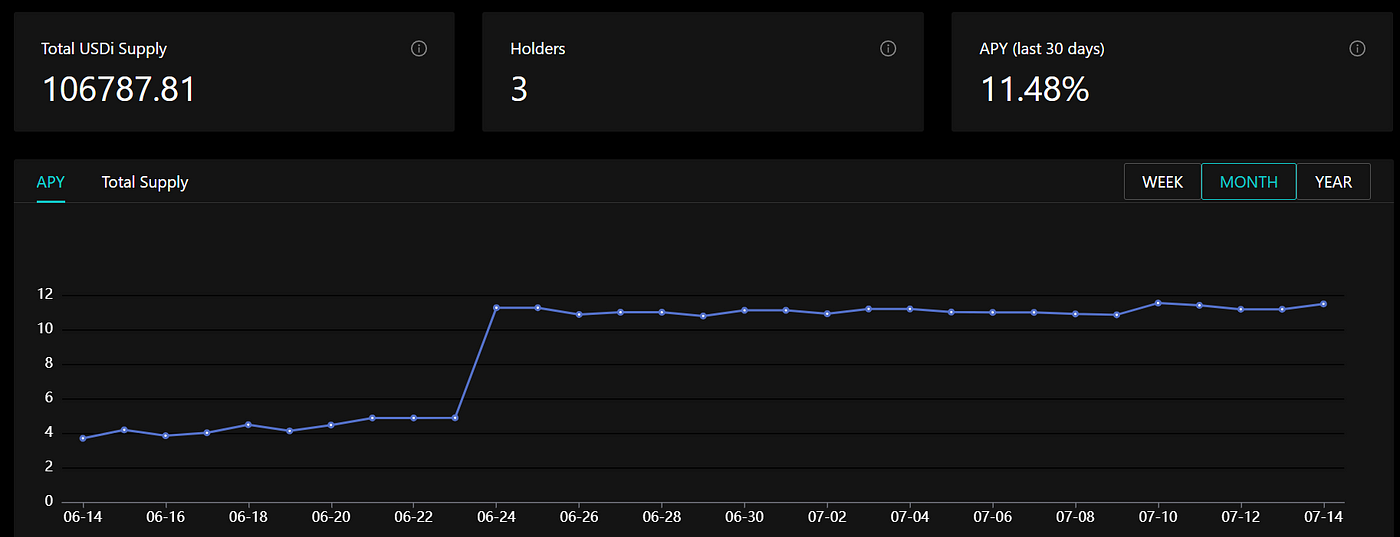

The sources of returns come from Automated Market Maker (AMM) fees, governance rewards and lending fees, meaning that BOC invests the money in these strategies types within secure and reliable protocols, and the returns generated are fully transparent and displayed in the BOC app dashboards. There you can see, in real-time, not only the investment strategies and the percentage invested in them but also the protocol performance history and vaults details.

How is BOC better than other DeFi protocols?

BOC seeks to provide solutions to the common challenges and limitations of other DeFi protocols, such as yield volatility, operations complexity, extensive knowledge of the field required to operate, non-transparent strategies or performance, circular dependencies, and impermanent losses, among others.

In this way, BOC offers sustainable returns, full transparency on all operations and investment strategies or fund allocation, due diligence performance and, most importantly, super-simple procedures for all, becoming BOC’s one-click compound wealth management platform the best way for newcomers to enter the crypto and DeFi ecosystem.

How is this possible, i.e. how can BOC achieve a secure and nearly risk-free approach?

The BOC platform connects protocols within the crypto ecosystem, including Automatic Market Makers (AMMs), lending protocols and yield aggregators. The protocol has a reliable risk control procedure and, by accessing high-quality strategies, it can be 3–5 basis points higher than other USD-managed funds, with the potential to attract millions of dollars in investment. Stablecoins, blockchains and strategies used by BOC are rigorously selected and tested; and the BOC algorithm provides optimal funds allocation services combining the two principles of maximising returns and diversifying capital risks.

Furthermore, BOC achieves a secure and nearly risk-free approach primarily through the selection of well-vetted protocols such as AAVE, Alpaca, Balancer, Convex, Curve, dForce, DODO, Pancakeswap, Quickswap, Synapse, Sushiswap, Uniswap and Venus; also through attack prevention by incorporating the Chainlink Oracle; and through fully automated yield optimisation with portfolio rebalancing and audits by trusted third parties, which is currently ongoing.

In addition, BOC avoids including insecure mechanisms such as circular dependency ones, algorithmic stablecoins (which are not asset-backed) or risky third-party bridges, and presents a low risk of impermanent loss, due to the way deposit vaults work.

BOC’s present and future

The BOC team is working hard to launch the new governance token soon ($BOC), which will bring new features and benefits for participating in the protocol’s Decentralized Autonomous Organization (DAO). Besides that, there are several advances and improvements planned in the roadmap, such as connecting more blockchains (Fantom, Algorand, Solana, etc), adding alt-coins farming through lending, smart contract insurances (Nexus Mutual), and developing other services offered in traditional banks, but without intermediaries and complications.

BOC is making daily progress towards its medium and long-term goal of offering personal banking services such as transfers, exchanges, deposits/withdrawals and money lending/borrowing; payment solutions such as payroll and subscription services, pay-as-you-go compatibility, cross-border settlement and even the issuance of its debit card; and institutional services such as meta-governance, principal-protected notes for non-fungible tokens (NFTs), DAO treasury management and currency forward contracts.

In this way, BOC aims to complete the path towards a fully-fledged decentralized bank (DeB).

Currently, BOC functions as a yield aggregator and is working to develop the rest of the envisaged functions. The protocol is Ethereum Virtual Machine (EVM) compatible and is already connected with Ethereum, BNB Chain and Polygon networks.

In the future, we will see BOC, as a disruptive platform, playing a vital role in transforming the ecosystem around the crypto-investments industry and decentralization in various industries.

Learn more and start earning on the BOC Platform

📲 Connect: Keep up to date with all the latest developments along the way by staying tuned to BOC’s networks.

👁 Explore: Start earning with BOC now! The lending facility will be launched soon.

🧠 Learn: Find out more about BOC by accessing the protocol documentation.

👥 Community: Join our Discord and Telegram groups to participate in the latest community discussions on BOC.

🗳 Governance: Follow BOC governance profiles for more news on the upcoming DAO and all proposals.

首个DeFi银行诞生,算法分散投资实现近“零风险”长期稳定收益

您是否想要进入加密行业,但是不知从何入手?想进行加密货币投资理财,但怕一不留神亏得血本无归?

BOC: 我们来了!

BOC(Bank Of Chain)是帮助普通投资者获取链上近“零风险”收益,保本理财的一款去中心化金融协议。

BOC平台连接加密生态系统内诸多协议,例如AMM、借贷协议、收益聚合器等。通过接入高质量低风险的策略,使其APY能实现比其他类似的美元管理基金高4–5%。

对于加密行业的新人来说,BOC无疑是进入数字资产投资回报生态系统的最佳渠道!

通过BOC平台,任何人都能立即简单地获取链上收益,不会再因门槛而对加密行业望而却步。

BOC 起源:我们为什么开发 BOC?

现有的DeFi协议存在一些潜在的问题:

- 在去中心化交易所里做市,存在无偿损失。在2021年,UniswapV3做市收入约2亿美元收益,这些资金池遭受了2.6亿美元的无偿损失,导致6000万美元的净损失总额。

- 部分收益聚合器存在循环依赖的问题。

- 部分协议投资门槛很高。一些收益聚合器产品内有众多机枪池,用户需要较高的知识储备才能正确选择投资时机和投资哪些机枪池。同时,不同的DeFi 产品需使用不同币种投资,投资过程也较为复杂,需要实施取币、兑换、收割、调仓和复投等一系列专业操作,投资成本可能会相当大。

因此,BOC协议通过智能合约连接加密生态众多协议实现分散投资,算法自动接入高质量低风险的策略,以创造接近“零风险”的长期稳定收益,解决了这一问题。

产品介绍: BOC及其运作机理

BOC是首个去中心化银行(DeB),与现实世界中的银行类似,用户可以存放其加密资产,协议反馈 USDi & ETHi 给用户作为其存款凭证,用户可以随存随取。

用户存入的资产进入BOC资金池,开始积累收益,收益自动复投,历史和动态收益直观可见。您可以当BOC是您区块链上的财富管理工具。

BOC如何创造接近“零风险”的长期稳定收益?

BOC所使用的稳定币,区块链和策略都经严格挑选测试。定期评估各资金收益变化,权衡调仓成本与收益,收益聚合器会寻找兑换最佳路径。进行外汇收益套利,并根据汇率和收益波动自动增减杠杆。协议提供资金链内择优分配服务,该分配兼具回报最大化及资金风险分散两项原则。

目前挑选出的协议主要有:Convex、DODO、SushiSwap、Balancer、dForce、Synapse、Venus、Belt、Pancakeswap、Alpaca、Quickswap、Aave、Curve、等。

BOC的收入来源:

- 为DEX提供做市资金收取的交易手续费 。

- 为超额抵押借贷提供借贷资金收取的利息 。

- 在以上过程中获得的协议治理币补贴。

拟定路线图:BOC的未来

BOC团队正在努力尽快连接更多区块链(Fantom,Algorand,Solana等),推出山寨币借贷理财(Sushi, Yearn, Convex等),整合智能合约保险(Nexus Mutual),以及开发传统银行提供的其他服务。

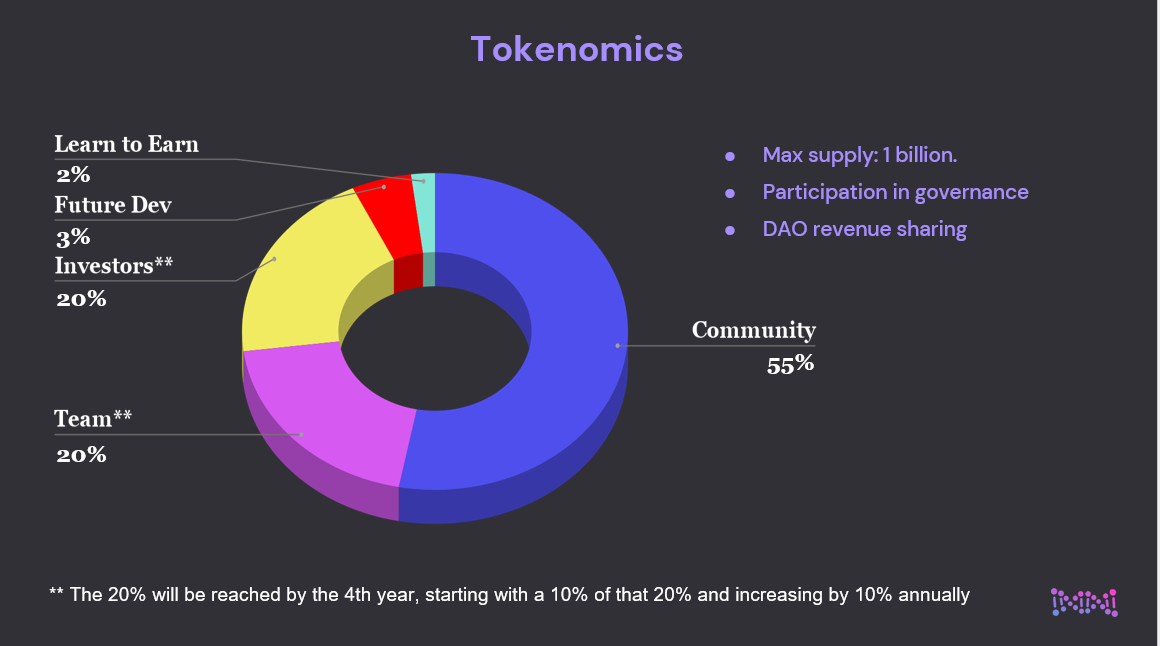

BOC计划发行治理币($BOC)10亿枚。代币持有者将根据持有比例获得BOC管理费用收入,参与治理并共享收益。

BOC目前处于去中心化银行(DeB)的发展中阶段,其目标有:提供个人银行服务,如转账、兑换、存款/取款和借贷; 作为支付方式,如工资发放和订阅服务,预付款,跨境结算甚至发行借记卡; 提供机构服务,如元治理,DAO金库管理和外汇远期合约等。

BOC目前作为收益聚合器,正在快马加鞭完善并开发其他业务ing……

未来,我们会看到BOC在将各个行业向去中心化这一趋势推进的过程中扮演至关重要的角色。于此同时,我们非常高兴您也能成为这其中的一员。

现在开始:BOC与社区

🧠了解更多:点击此处进入BOC官方白皮书,了解更多关于BOC的开发历程、产品现状、运营模式、未来产品发展、以及如何开始使用BOC等信息。

👁探索BOC:现在开始从BOC上获得收益! 借贷功能即将上线。

🤝BOC社区:加入我们的Discrod社区 和 Telegram社区以参与BOC的最新社区讨论。关注@bankofchain_dao 推特账号以获取最新咨询。

💻管理BOC:所有BOC智能合约均由独立实验室(SlowMist等)进行审计,目前通过Gnosis多签实现共同管理。BOC使用Forum进行提议,Snapshot 进行投票。

BOC更多平台链接:Bank of Chain | Linktree